In this guest post, Nileema Somani, busts several myths about Actuarial science jobs, courses and salaries.

5 Myths about Actuarial Science Jobs and Courses

by Nileema Somani

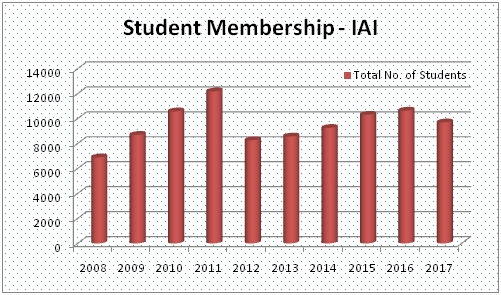

Let me begin this article by showing you some numbers. As per the 2016-2017 annual report published by Institute of Actuaries of India (IAI), the growth of actuarial students for the past 10 years has been as shown in the graph below:

As we can see from the graph, there is a steady growth in the number of students in the first four years (2008-2011) and then we suddenly see a big dip in numbers in 2012. Post this, it is changing marginally. Here are some facts that explain the dip in the number of students in 2012.

In May 2011 attempt, 626 people attempted the CT3 paper (Probability and Mathematical Statistics) and none of them passed. This was as disturbing for the actuarial students as it was for the institute.

In the words of the then IAI president (Liyaquat Khan) published in the Annual Report (2010-2011) – “The CT3 results have stuck on our face: none passed out of 626 students who appeared. CT6 is no better, some two passed out of more than 300. Both the subjects are Statistics related and the very foundation of the actuarial science.”

Thus IAI came up with a more robust student entry system to provide a fair platform for potential students to see what is in store for them before they get neck deep into formal actuarial studies. This in when the Actuarial Common Entrance Test (ACET) was introduced. Actuarial aspirants were required to clear ACET to qualify for giving actuarial papers.

At first, this seemed like a pretty harsh decision from the institute and the numbers also supported our view (since the student members fell drastically in the year ACET was introduced – 2012). But later the institute did witness higher rate of successes amongst ACET students as against others and they knew that they are in the right direction.

The reason for me to show you this graph is to let you know that unlike other professions, this profession has very limited number of members and even fewer numbers of fellows (By fellow, I mean a person who has cleared all 15 papers and is fully qualified). To be precise, as of 31st March 2018, we have just 379 fellows in India.

This explains why the demand for actuaries is so high in the market. While this profession can be a very lucrative and self-fulfilling, one needs to be fully aware of what one is getting into.

Being an actuary would cost you anywhere between 8-10 years and even more. This means that you get to spend your most fruitful years (20s and mid 30s) giving actuarial papers.

This is enough to give jitters to people who think of opting for this profession and to add insult to injury we have this actuarial bubble floating in our society which makes it all the more difficult for them to decide. This article is my attempt to help you understand this profession better and to make you more informed about this domain.

Here are some most common misconceptions that people have about our profession and as an actuarial aspirant with around seven years of experience; I am sharing my thoughts on the same:

1. Actuarial science is all about mathematics and statistics

Mathematics and statistics are tools through which we apply the actuarial principles and hence these subjects area foundation of the profession. But along with this, we also have other elements like risk management, economic principles, modelling, communication.

To take an example, a typical life insurance company has anywhere between 5-10 sub-teams in their actuarial wing. These teams are involved in different kinds of work like; experience studies, valuation, reserving, modelling, asset liability management, pricing etc.

The work involves – reporting, analysis, data validation, modeling, experience studies and the like. Thus the profession is much more interesting and diverse than it may sound in the first place.

2. Actuaries are the highest paid professionals

If there is one myth that needs to be busted, it has to be this. I feel the package in our profession is thoroughly overrated. A lot of people are running their businesses (read coaching centers) on this ground.

There are a lot of factors that decide one’s package in this domain; some of which are – the number of papers cleared, the domain you belong to (life insurance, pension, general insurance etc.), the number and quality of work experience that you have, your area of expertise, whether you work for a domestic company or an MNC.

Papers are just one of the many elements that contribute to the earning of a person. It is a combination of different factors that decide your package. It is an over-simplication to say that package is directly proportional to papers cleared.

3. Actuarial science is only about intelligence

Undoubtedly actuarial science is a highly technical profession, but with fair degree of intelligence, it also demands determination and perseverance. The actuarial examinations are broadly structured as technical papers (CT Series), practical papers (CA Series) and specialization papers (ST and SA Series).

The requirements for all these three sets of papers are fairly different. This can make this profession a roller-coaster ride. Along with decent intellect one also needs patience, consistency and practical experience to fare well in this field.

4. Coaching is the only option available to students

A lot of students are under the impression that the actuarial exams are difficult to clear without the help of coaching centers. This is not completely true. There are many who do clear papers without seeking any guidance and this is because the course material is pretty exhaustive.

Moreover the actuarial institutes do suggest reference materials; if any. They also provide tutorials in some cases. For example IAI conducts classroom sessions for different subjects and similarly the Actuarial Education Company (ActEd) conducts online tutorials on behalf of Institute and Faculty of Actuaries (IFoA), UK.

One of the benefits that come along with these online tutorials is that you can revisit the modules as many times and at any time as per your convenience. While coaching centers do offer classes, they may sometime mislead people about the profession and may emphasize too much on “tricks and tips to clear actuarial papers” and in a way promote selective studies.

This might not always work in your favor and in this field selective studies can land you in trouble during job interviews. One needs to be thorough with the concepts as the subject never leaves you, even when you have cleared it.

5. Actuaries only work for insurance companies

While most of us work for insurance companies, it does not mean we do not work in other domains. Actuaries do exist in other fields’ like- banking, strategy, business planning, risk, finance and even in other unconventional fields like L&D and training.

In actuarial course we cover a myriad of topics and skill sets; like modeling, financial economics, statistical methods, insurance principles, investment principles, enterprise risk management, communication essentials and more.

These skill sets would help a person move into a lot more areas than what is generally perceived, after all at the end of the day the skills acquired matter more than the degree.

I would like to conclude my article by stressing on the fact that the actuarial domain is much more diverse, interesting and challenging than a common man perceives.

As a word of caution, do not believe everything you hear about this profession. It is always good to speak to an actuarial professional or to get in touch with the actuarial institutes to understand this profession better. Do not fall into the trap of the actuarial bubble!

Cheers,

Nileema Somani

About the author: Nileema Somani is an actuarial professional with a leading Life Insurance company. She currently looks into the learning and development of the actuarial team in her organization. She is an active member of IAI and works closely with IFoA (UK) for the development of the actuarial students in her organization.

About the author: Nileema Somani is an actuarial professional with a leading Life Insurance company. She currently looks into the learning and development of the actuarial team in her organization. She is an active member of IAI and works closely with IFoA (UK) for the development of the actuarial students in her organization.

Is it a good idea to join actuary without having a bachelor’s degree?

To what extent does the bachelor’s degree matter? Can I do my bachelor’s from IGNOU?

You can appear for actuarial examinations anytime after your Class 12th. College doesn’t matter much in this field, your intelligence and practical knowledge is what required. But a good college in your CV sure creates a better impression.

Can you please tell what is the average package of an actuary who has cleared some papers (say 4-5) & what is the package of a person who is fellow actuary?

Hello Lucky

Packages can vary a lot depending on your previous experience and the kind of industry you are in. If you are a fresher the number of papers may hardly make a difference… but the way you progress in papers once you start working might make a difference

Can I gain work experience lateer after clearing the requested number of papers. I am 23 years old. Is it risky if I prepare for the exam in actuarial science at home without s job in hand. I am confident. Please guide me

Plz reply

I m 34 yrs old… I competed my bsc msc… Can I go in actuarial science field

Actually I hv prepared fr IAS bt not made it

So nothing in hands yet.

Plz guide

Hello S Mohan,

There are companies who hire actuarial candidates even with 0 papers, provided you have cleared ACET.

It is not at all risky to prepare at home, infact I would highly recommend it.. I have cleared most of my papers by studying by myself 🙂

Madam, My daughter cleared 12th and looking for acturial course. Whether she should join some college for B Sc (acturial science) and then go for Institute of actuaries of India. Or is there a direct entry /any other way to enter into Institute of Actuaries of India. Kindly reply.

My daughter has cleared 7 CT paper and now she has to choose one specialist is SA series kindly advice which line will fetch her more salary and remuneration ie life ; pension; General or Health ?

Hello sir,

I would suggest that she should go with the one she is most interested in. The demand is changing very fast and each sector (Pension, Life, Health) has its own importance and career prospects. If she is good at what she does, she will be in the right place grabbing the right opportunity..

Please advise a tutor to. Help.i am staying in Chennai

Good day, I just acquired a B.sc Accounting and I want to know if actuarial science is a good course for me to master in?..?do they complement each other and what should I expect?.

I’ll really appreciate your response. Thank you.

Hello Ukeme

If you she a knack for numbers and you like the concept of probability, risk management and analyzing financial conditions, this can be an interesting profession for you.

Also you need to be patient with the qualification as it may take sometime before you qualify…so being resilient is an important factor here 🙂

Can I start this as a career at age of 31. Am I too late for this. I will be switching from an engineering role (core technical) to this . Will I find a decent employment which could atleast give me my previous pay or maybe 1-2 lacs less is also fine.

Ofcourse! It’s never too late. Having said this, you reason for switching is important. If it is just for money, you will have to measure the pros and cons and it may not be the best option to start from scratch (just incase your previous experience do not complement the requirements), however I know of organizations who are hiring non-actuarial people in the team to fulfill their technical demands..so yes a little bit of research required there.

Hi Nileema,

I had a few questions. I am a Career Counsellor and every career counsellors “cool move” is to tell the student about Actuarial Sciences.

The problem that I face are the following

1. I know a couple of students who have cleared 6 papers and had to do an MBA to get a good job. (Including CT3 and 6)

2. MBAs and Msc Statistics are slowly moving into the Acturial space, a lot of Msc Acturial sciences guys work in the space.(Not an actuaries, but associates to them)

If someone clears 6 papers there was a belief that salary equivalent to 12 lakhs per annum can be expected.

What are your thoughts on it?

Hi Yash,

To answer your first point, from my personal experience I do not think an MBA at the start is beneficial to get an actuarial job. The only benefit the candidate will have is that they can sit for placements and may grab a job. However spending a few lakhs just to grab an actuarial opportunity is not a good option. One should instead search smartly – get to the right contacts, consultants and now the IAI (Actuarial Institute India) also advertises open position in various forms. So one can apply from there.

From the salary perspective – an actuarial fresher is a fresher irrespective of the number of papers he/she have cleared. Having more papers as compared to another applicant may give you a little advantage in package, however in the long run it is your progress in papers and performance at work…

Hope this helps

I want to clear my actuarial papers faster should I go for IAI or IFOA ? I have Listen that IFOA has better passing rate ? Also I have listen that CA , SA and ST series are difficult for IFOA then IAI ? Are these facts true pls help ?

Hello Ma’am,

First of all big thanks to you for creating this wonderful blog on acturial science. It really created an insight in me. I’m Bcom(hons) graduate with specialization in Risk Management and Insurance. I’m farily good at mathematics and statistics too(although my calculus is not upto mark) I really got hooked up on acturial science so I’ve almost taken an Admission for Msc.acturial science. Instead of just writing the exams I thought I’d take a post graduate degree on it. Is taking msc on the subject worth it or a good decision? It would be really helpful if you shared your thoughts on it ma’am.

Thank you Ma’am

Hi Nileema,

I’m 18y/o(currently in 12th commerce ) should i go for ca course or actuarial science. I have started preparing for both cm1 as well as ca foundation and both are going pretty good for me. But i am confused regarding my future. Also package wise is actuary as lucrative as ca or less.

Pls reply